Most people stare at numbers and hope for patterns. We teach you how to spot the signals that matter, understand what drives real movement, and present findings that actually influence decisions.

I spent years looking at spreadsheets without really understanding them. Three months into this program, I started connecting dots I didn't even know existed. The difference isn't just technical—it's about confidence in what you're actually seeing.

Most programs dump theory on you and expect it to stick. They teach formulas without context, methods without reasoning. You memorize ratios but can't explain why they matter.

Start with real scenarios, not textbook examples. Work through messy data that doesn't behave. Learn to spot what's relevant and what's noise—because that's the job.

Anyone can calculate a price-to-earnings ratio. The question is whether you know what it's actually telling you in context. We dig into the interpretation part—the stuff that separates someone who can use a calculator from someone who understands what's happening beneath the surface.

See curriculum details

Here's something they don't tell you in most finance courses: being right doesn't matter if you can't explain it. Half our time goes into helping you translate complex analysis into language that executives, clients, or stakeholders can actually use to make decisions.

Learn about our methods

Skills that translate directly to better work, clearer thinking, and stronger contributions to your team

Train your eye to catch inconsistencies, trends, and outliers that others miss in financial data.

Numbers mean nothing without context. Learn to factor in industry dynamics, market conditions, and timing.

Build reports that people actually read and presentations that drive action instead of confusion.

Question assumptions, test hypotheses, and avoid the trap of accepting surface-level explanations.

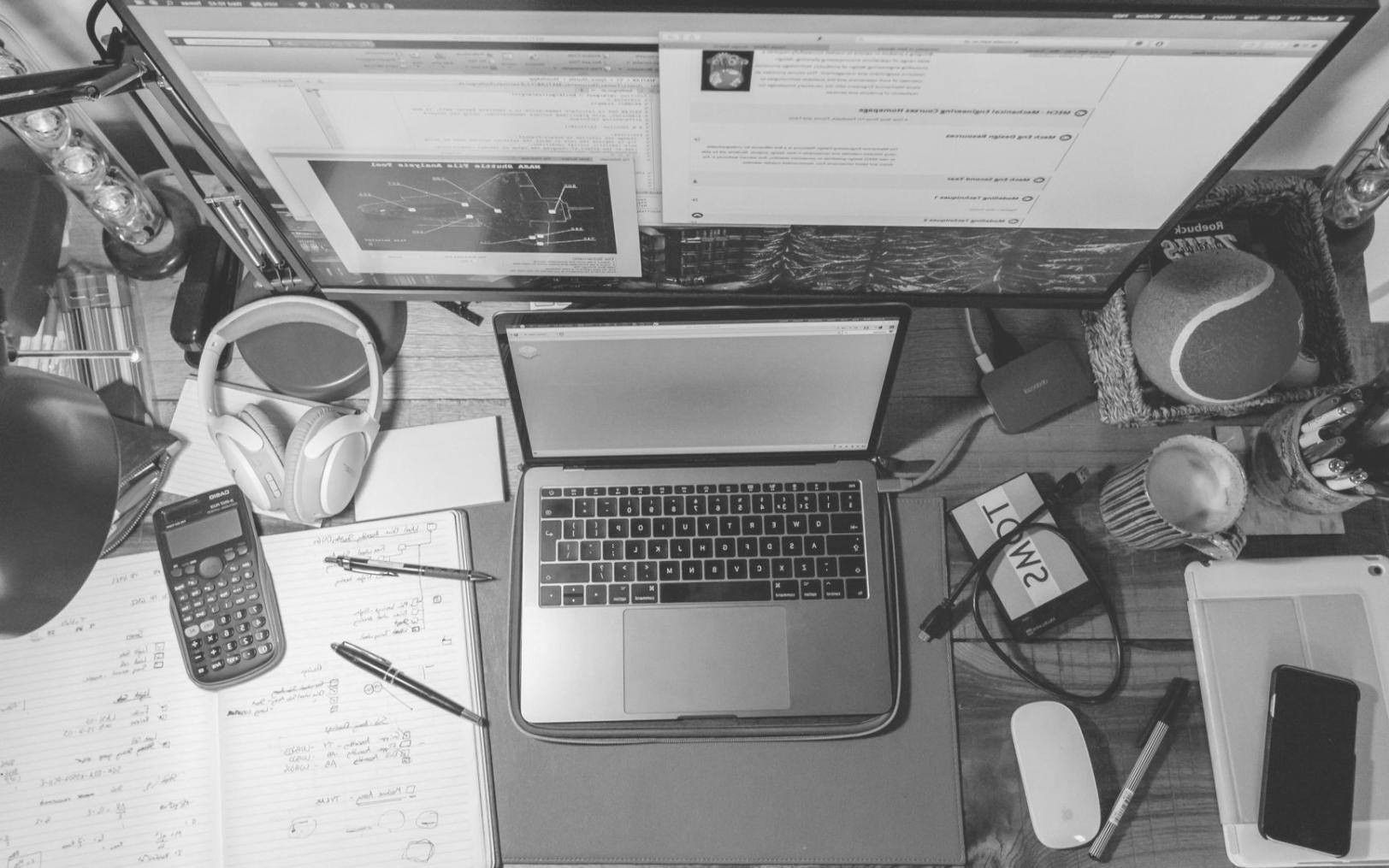

Work with the same platforms and software used in actual financial analysis roles across industries.

Understand compliance, documentation requirements, and professional expectations in financial reporting.